I still feel like I am 22 even though I am a 35-year-old mother of (almost) three! Sometimes I find myself doing real life #adulting and thinking to myself, “when did I get here?” I am not sure if any of you can relate, but despite feeling younger, I always feel so accomplished and even proud of myself when I tackle a new life lesson or responsibility head on, figure it out for myself and learn something new along the way.

I’ve partnered with Spire to introduce their new car insurance to my fellow Texans and Houstonians because I believe that all of life’s big decisions should feel this simple and transparent. As part of your new year checklist, do yourself and your budget a favor by taking a moment to get a quick quote. I am sharing all the details below, I hope you find it as simple as I did!

In our marriage and family, Fred’s job is definitely the most demanding of the two of us. He is responsible for a commercial real estate fund that focuses on all of North America which has him traveling several times a month. I pride myself in being completely capable of making important decisions for our family, finances and household on my own if he isn’t around when things need to get done. Of course, he is always just a phone call away and I always run everything by him before making any big decisions, but knowing I can handle it brings peace of mind to both of us.

Every year I take a look at all of our fixed expenses from insurance to cable bills and actually take the time to do my due diligence to make sure we are getting the best service at the most affordable cost. As I was taking the time to do this in the new year, Spire Insurance reached out and I was immediately intrigued to learn more.

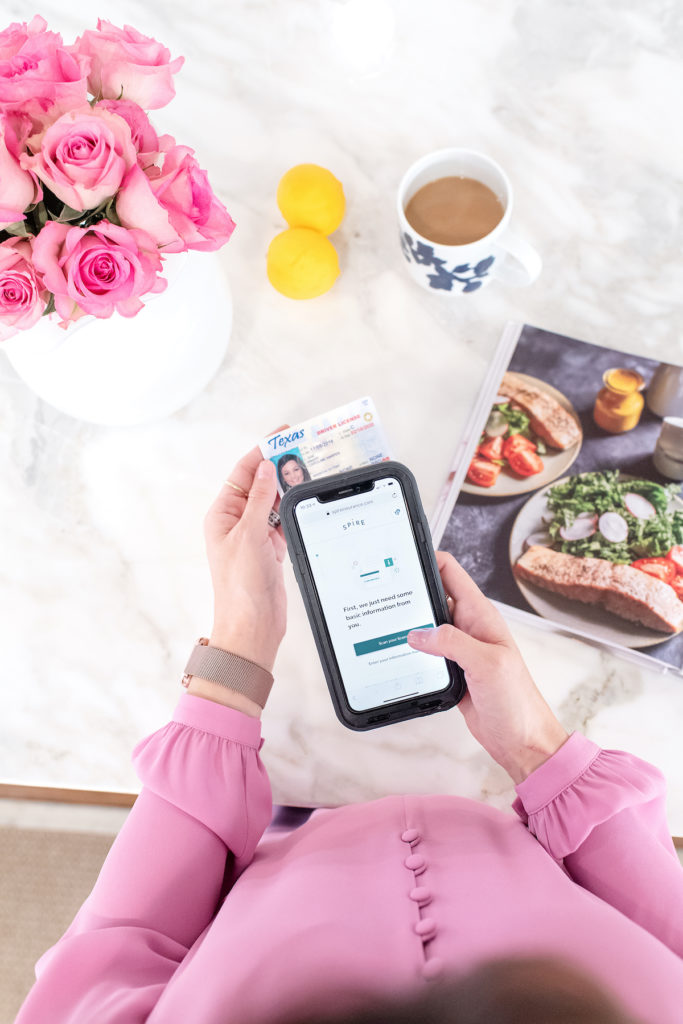

Spire is a new approach to car insurance—it’s a simple, easy-to-understand digital insurance platform offering key products and services tailored for millennials. It is designed to be convenient and accessible from your phone so you can get a quote while you are enjoying your morning coffee or making dinner. Spire is a mobile first platform that will initially offer auto insurance with future plans to include other products and services that help millennials protect the many aspects of their lives. And right now, it’s just available in Texas, lucky for me 😉 But, they do have plans to rollout in other states soon!

Like most of the challenging and intimidating tasks that come with becoming an adult, finding the right car insurance can often seem too overwhelming due to the amount of time it takes (who wants to sit on hold while being passed around to different departments hoping to find someone who can actually help you) and for the lack of transparency around the coverage and pricing. Spire set out to address these issues, providing a simple way to secure insurance that feels fair and relevant to your life. Using the Spire mobile web site, I was able to secure an auto insurance quote by simply scanning my driver’s license and answering four simple questions: Where do you park, do you own or lease your car, how many miles do you drive, and have you had more than two tickets in the past year?

Spire stripped out the traditional rating factors that other companies use, like gender, marital status and employment status. Instead, they ensure customers’ premiums are based on simple, understandable factors like who you are (your age and your payment history), what you drive, where you drive and how you drive, and provide coverage explanations that are easy to understand without using industry jargon. The quote

process can take just a couple minutes and presents you with

straight-forward options to let you find what you need.

And since breaking up is hard to do, they even handle ‘the break up’ with your current insurance provider for you. (See, I told you they make this simple!) Once your coverage starts with Spire and you agree, they give you the option to let them cancel your current provider for you taking one more thing off your already busy plate. They will only cancel your auto insurance and you will receive a copy of the cancellation request so you know exactly when it was processed.

I can’t wait to hear what you think and how much you can save with Spire. Please let me know in the comments or DM me on Instagram. Here’s to convenient and smart innovations to make life’s decisions a little easier (and more affordable)!

Leave your thoughts